Monday, 13 January 2014 The Sharks of Buying Rental Properties Being a new Canadian investor can be a bit like dipping your toes into a shark tank. There are professionals and tradesmen who could take a big bite out of your wallet . When many first time investors take that plunge into the investment property game. They may be armed with little or no knowledge about the game. While you can’t learn it all right away . Asking important questions and taking a few precautions might save you injury.When dealing with the biggest investment most of us will make, unscrupulous mortgage brokers can put you in harms way. Realtors can lead you into making a bad decision.|These sharks can cost you an arm and a leg. A few precautionary measures can help protect you. When dealing with contractors I do not like to pay them until the job is done. Paying first can make you the side project . Or worse yet they start and never finish. Also it’s a good idea to get it in writing . Have the two of you write down exactly what you expect from them and what they expect from you . Have it signed and dated. Mortgage brokers can be great but giving them too much power can land you on the hook for surprises . Ask questions , read the details of the contracts. I recommend asking for the underwriters contact information. And start your own dialogue about what to expect . When choosing a Realtor ask friends or family who they used and would they recommend them. Communicate what you are looking for with the Realtor and ask what kind of commitment they expect from you . Many will ask you to sign a contract making it exclusive . Check around , is what they offer typical for the industry. It would be a book in itself to cover every possible danger . Cover your basics . What’s the reputation of this professional ? Remember to get it in writing . What’s expected of you and what’s expected of them ? The devil is in the details , or is that the shark ? by Glenn Brown

1 Comment

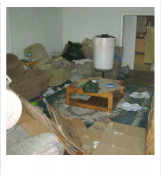

Sunday, 19 January 2014 Investing in Canadian Real Estate Three Approaches Passive income is one of the most rewarding roads to travel . Investing in Canadian Real Estate is one of my key strategies to receive passive income . Some of the giants of financial literature (think; Rich Dad Poor Dad) remind us that the highest taxed income is earned income. A more favourable taxable income is passive income. Which by definition means you make your investments and sit back and watch your bank account slowly grow. Money earned from rental property income is in this classification. That said, there are many different techniques real estate investors can use to earn this and I’m going to cover a handful of them that might work for you. The single family home may be one of the easiest investments to start with . Quite simply, you buy a home and rent it to one individual or family. Each month you collect your rent from the tenants of your home. In return, you as the landlord must pay the Mortgage payments, property taxes and insurance. Utilities are optional to include however,my preference is to make the tenant responsible for these fluid pay per use services. The important factor in this operation is to make sure the rent covers all of the fixed costs associated with your rental unit. There are many financial calculators available to help you accurately estimate these expenses (Bank websites, realtor.ca). Enter your expenses into the box, to this number add your property taxes and insurance costs. If you’ve done your homework well, you should have a bit left over after all of your expenses are paid. The next option for would be investors is a multi-unit property. This is a building that can accommodate more than one family. Duplex, triplex and fourplex are common forms of multi-unit investments. The advantages to these over a single family unit is your price per door. Where a single family home could net you $850 in rent, a duplex may get $700 + 600 for both units. This will bring you more cash flow for your investment. One might expect to pay more for a multi-unit but there is only one property tax bill, one mortgage payment and one insurance premium . Typically you will need 20% of the purchase price down to pick up a investment property. Anything with 5 units or more is now considered commercial and the rules change. You may get away with less than 20% but expect to pay a higher mortgage rate, CMHC fees and insurance premiums. A less considered strategy is a Rent-to-Own. The basics of this idea is to purchase a nice home in a nice area. The next step: find people who would like to own your home but can’t quite make it happen. An upfront payment is collected from the Rent-to-Own tenants Every month a portion of the rent is set aside to help with the purchase of the home . After a 1-3 yr period the tenant uses the upfront payment and collected premiums to buy your home from you the investor. With the money you’ve earned from paying down the mortgage and the appreciated home value, you are free to move on to your next endeavour. *** Legal disclaimer: As with all advice offered on this blog , it is to be considered the author’s opinion and legal advice should be sought out from a professional.  Tuesday, 7 January 2014Investor Pitfalls Avoid these 3 beginner investor pitfalls Are you looking for homes below market value ? They aren't always a deal . When I began looking for investment properties I took it upon myself to search the MLS for deals. I would find out what a 5 plex was going for . Then find one an hour away for half the price. then I looked at a Tri-plex in a small farming community . I chased the deals all over southern Ontario. And time after time I discovered why they were listed well below market price. From a lake in the basement, to a residency for rats to the middle of nowhere , my realtor and I drove . You get what you pay for , as the saying goes.Buying a solid investment property you don’t have to sink a ton of money into, is going to go for close to market value. If it’s at a steep discount buyer beware ! Know what you want and go and get it . I ‘d gotten one property under my belt and was ready for another. So my Realtor Terry and I set out looking at another single family unit. After looking at a few , I did some calculations . I figured if one unit got me a $ 150 cash flow, a duplex must be double . The same logic applied to a triplex and then a 5-plex . We drove around and looked at them all . In the end I wound up purchasing a single family home in a nice area. What a waste of time . If I only stayed focused and knew what my goal was I would have been in the game sooner. Thank goodness Terry is a very patient Realtor. Another lesson , Don’t get greedy ! It was 2009 when I came across a decent duplex for sale . The rents brought in $ 750 downstairs and $ 500 up . I knew that after the recent housing crash I could “low ball” this investor . After chipping away at his purchase price I got him within $2000 of the price I decided I wanted it for . Neither one of us budged after the last offer and I let it go. I still regret walking away over that . If I would have come up a bit more that duplex would be one of my better cash flowing properties. If the numbers work (and you should know those before hand) then ask yourself is this worth walking over ? To sum up, it's very easy to get caught up in finding the best deal possible. Have a direction, at least know where it is you want to be. Ask yourself these questions “why am I doing this, and where do I want to be ? Happy house hunting . **** As with all advice offered on this site, it is recommended to get professional legal advice before proceeding. Glenn Brown  Sunday, 19 January 2014 Expediting Bad Tenants Cash for keys program Your rent is overdue for several months . The tenants are impossible to get a hold of. Anytime you do speak with a tenant they have a new tragic story to share. What could have gone wrong you wonder ? Everything started out well , they gave first and last months rent. But then they were a bit late with the rent. And you thought I could wait a bit. Rent arrives some time next month then they couldn’t pay all of it. “ Money should be coming soon” they proclaim , if you could just wait a bit . This is the property owners nightmare. You have got a bad tenant and it’s time to deal with it! Maybe you feel bad for their predicament and maybe it’s even legitimate . But your bank or mortgage company doesn’t accept stories and neither should you. Now is the time to take action . There could be a solution but it might make you angry . So I need you to keep an open mind. I would like to introduce the cash for keys program. If you want your delinquent tenants out suggest this to them. Your conversation could go like this “ hey John Tenant, I Know you and the family have had it hard lately . I have a solution for both of us “ . Offer to give them $600 cash to use towards your next apartment . Let them know you will forgive whatever is owed and the only catch is you need to be out by the first of next month. Not only that, I need this place vacant and broom swept before I hand over the keys. Ok, property owners I told you you might get angry . I would like you to consider how much your current tenants have already cost you. No rent for the mortgage or property taxes , if you pay utilities then this too costs you. Not to mention sleep and your peace of mind. If these habitually late renters look like they are about to move, fantastic! If not they could go on for months while your savings dwindle away. If our Canadian government has a resettlement plan to get rid of undesirables why can’t we . The premise behind it, pay a little save a lot . Expect the tenants to be skeptical . This might feel like a trick . Assure them you have amicable goals. Tell them you will have your lawyer draw up an agreement stating in exchange for vacating the property by the end of the month , you will provide x amount of dollars to get them on there feet. This might feel like the answer they were looking for . A fresh start for them and you can begin to get the unit rented out . This time to the right people . Of course our goal as property owners/ managers is to avoid being put in this situation altogether . Good tenant screening and prompt reaction to non-compliances will help teach your renters what you expect of them . If you still have your doubts, having an experienced property manager minding your rentals makes sense. Knowing the laws and regulations keep you on top of things .  Monday, 27 January 2014 Rental property advertising in Ontario Canada If you own a rental unit and need to advertise a vacancy, there are a few low cost to free options you have available. Before the on-line world exploded property owners needed to spend a bit of money to advertise their home for rent. With today's technology getting easier and more accessible, putting your hone on-line makes sense. The first step in this process is with the property itself. Prospective tenants want to be able to picture themselves living in your rental unit. Have your repairs done and the place sparkling before advertising. A good quality camera or device is required to capture your home at it's best. As stated earlier there are now choices for you to let people know you have a home for rent. Kijiji is one of my favourites I've used with much success. If you don't already have one create an account with them to advertise. Choose the town/city you are advertising in . The cost is free. But after a few days your ad' gets bumped down a few pages and might not be easily found. For a small fee you can do a bump up and have your ad' at the top of the list once more. A brief description of what is offered and your asking rent is required. Let people know when the place is available and the best way to get in touch with you. Craiglist is another large platform to market on. You will again need to create a profile beofre uploading your pictures and text to create your advertisement. Another creative idea is too make a video of your rental unit. Give a guided tour of your home. Create some interest by letting people know if you are close to schools, or near public transit. Next step post your video to Youtube . This works especially well for sought after neighbourhoods or Rent to Own homes. Having said all this, don't count out the more traditional forms of media. Print advertising can still bring in traffic. Finding the right news paper is important, you don't want to throw away your dollars on an ad' no one will read. I prefer the free weekly paper as opposed to one requiring a subscription. The cost is low, and my target market are the ones who receive it. To round out your campaign, get some signage going. A lawn sign lets people who already live and work in the area know about your place, Vistaprint offers inexpensive advertising materials and it's shipped to your door relatively quickly. As with all advertising keeping track of your results is paramount. Split test are a great way to eliminate what doesn't work. Change your words up if an ad' isn't getting much interest. Compare the calls you receive for the new ad' against last weeks. Did your call volume suddenly go up? Try the same ad' in a different paper. Track your data and measure your results. There are many different ways to get the word out there. Be prepared, cover multiple forms of media and get ready for the phone to ring. Happy surfing! Monday, 27 January 2014

Rental property advertising in Ontario Canada If you own a rental unit and need to advertise a vacancy, there are a few low cost to free options you have available. Before the on-line world exploded property owners needed to spend a bit of money to advertise their home for rent. With today's technology getting easier and more accessible, putting your hone on-line makes sense. The first step in this process is with the property itself. Prospective tenants want to be able to picture themselves living in your rental unit. Have your repairs done and the place sparkling before advertising. A good quality camera or device is required to capture your home at it's best. As stated earlier there are now choices for you to let people know you have a home for rent. Kijiji is one of my favourites I've used with much success. If you don't already have one create an account with them to advertise. Choose the town/city you are advertising in . The cost is free. But after a few days your ad' gets bumped down a few pages and might not be easily found. For a small fee you can do a bump up and have your ad' at the top of the list once more. A brief description of what is offered and your asking rent is required. Let people know when the place is available and the best way to get in touch with you. Craiglist is another large platform to market on. You will again need to create a profile beofre uploading your pictures and text to create your advertisement. Another creative idea is too make a video of your rental unit. Give a guided tour of your home. Create some interest by letting people know if you are close to schools, or near public transit. Next step post your video to Youtube . This works especially well for sought after neighbourhoods or Rent to Own homes. Having said all this, don't count out the more traditional forms of media. Print advertising can still bring in traffic. Finding the right news paper is important, you don't want to throw away your dollars on an ad' no one will read. I prefer the free weekly paper as opposed to one requiring a subscription. The cost is low, and my target market are the ones who receive it. To round out your campaign, get some signage going. A lawn sign lets people who already live and work in the area know about your place, Vistaprint offers inexpensive advertising materials and it's shipped to your door relatively quickly. As with all advertising keeping track of your results is paramount. Split test are a great way to eliminate what doesn't work. Change your words up if an ad' isn't getting much interest. Compare the calls you receive for the new ad' against last weeks. Did your call volume suddenly go up? Try the same ad' in a different paper. Track your data and measure your results. There are many different ways to get the word out there. Be prepared, cover multiple forms of media and get ready for the phone to ring. Happy surfing! |

AuthorGlenn Brown is owner of My Rental Unit property management and has enjoyed success with multiple unit investing. TOpics

All

Archives

February 2016

|

Our services |

Company |

Rental units |

RSS Feed

RSS Feed